Alstom built the 30 MW oxycombustion steam generator system for the Schwarze Pumpe plant Brandenburg, Germany. Source: Vattenfall

The UK’s Department of Energy and Climate Change (DECC) places a mandatory requirement on gas-fired power plants to be built ‘carbon capture ready’ so they can be retrofitted at a later stage. Tim Probert speaks to plant developer Intergen, carbon capture OEM Alstom, engineering group Foster Wheeler and the Crown Estate to find what CCR entails, and whether ‘ready’ will ever become ‘retrofit’. This article was published in the November/December 2011 issue of Gas Turbine World magazine.

The UK likes to think it is a world leader in carbon capture technology. To demonstrate its credentials the Department of Energy and Climate Change (DECC) launched in May 2007 a £1 billion ($1.6 billion) carbon capture and storage (CCS) competition to build a utility-scale, full-chain demonstration project, with the winner expected to be announced a year later. Nearly five years on, the competition remains open and the money remains unspent.

On 19 October, DECC pulled the plug on Scottish Power’s project to retrofit a 300 MW unit at the 2400 MW Longannet coal-fired plant in Fife. The official reason for the withdrawal of support for the project was a technical problem with the plan to transport CO2 from the flue at Longannet via a 280km converted natural gas pipeline to the St Fergus gas terminal in Aberdeenshire and then a further 100km to Royal Dutch Shell’s Goldeneye gas platform in the North Sea.

The competition rumbles on and the new favourite is not a coal-fired plant, but a gas-fired plant. British Energy Secretary Chris Huhne MP says SSE’s proposal to retrofit a 385 MW CCGT unit with post-combustion CCS at its 1180 MW Peterhead power plant would be achievable within the £1billion budget and a decision is expected in 2012.

UK gas-fired plants must be carbon capture ready

The UK is pinning its hopes on CCS because it is a vital cog in DECC’s plans to “largely decarbonize” the power sector by 2030 as part of the 2008 Climate Change Act’s legally binding target of an overall 80 per cent national cut in carbon emissions by 2050. As of 23 April 2009, all combustion plants with an electrical generating capacity at or over 300 MW must be ‘carbon capture ready’ (CCR).

Gas plants are no exception. In order to satisfy DECC and gain Section 36 planning consent, developers must ensure sufficient space is available on or near the site to accommodate carbon capture equipment in the future; demonstrate the technical feasibility of retrofitting their chosen carbon capture technology; identify a suitable area of deep geological storage offshore (onshore CO2 storage is currently prohibited) and demonstrate the technical feasibility of transporting the captured CO2 to the proposed storage site.

One such developer is InterGen, which gained Section 36 consent for the 900 MW Spalding Energy Centre in Lincolnshire in November 2010 and the 900 MW Gateway Energy Centre in Essex in August 2011. Is CCR merely an inconvenient box-ticking exercise to gain planning consent?

“Absolutely not,” says Peter Lo, Gateway Energy Centre project manager. “InterGen supports fully the aim of achieving a low-carbon economy and a technically proven and economically viable carbon capture solution is an important part of the low-carbon future of the UK.”

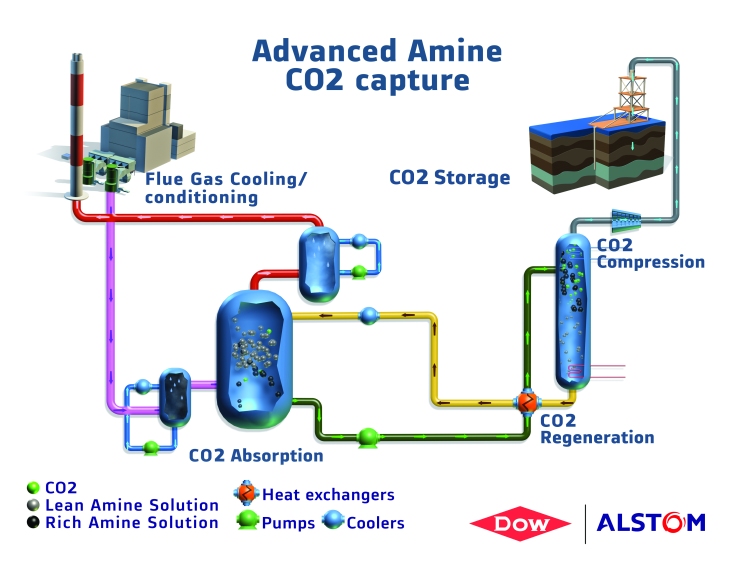

Lo says the feasibility studies for the Spalding and Gateway projects are based on post-combustion carbon capture technology using a chemical absorption method using amine solvents as it believes this is the best currently available technology suitable for scaling up to a size suitable for CCGTs. However, it does not expect to retrofit its CCGT plants until well into the next decade.

“Given the status of the technology and the demonstration projects and the advancements in such still needed, we consider that CCS could be retrofitted after 2025,” he says. In the meantime, new gas-fired plants like Spalding and Gateway will continue to be built ready for the day when the plant owners deem CCS to be economically viable.

What exactly is carbon capture ready?

There is a public perception that CCR is merely having a few spare acres of land. Not so, says Michael Ladwig, French carbon capture equipment OEM Alstom’s director of gas turbine product management.

“CCR is not just a patch of grass,” he says. “It’s a product we offer with all new gas turbine-based power plants, devised as a result of technical and economic research on potential problems arising from retrofits.

“It makes economic sense to make some technical changes to the CCGT plant to make it capture ready. One of the changes needed for CCR is a flue gas stack opening for the connection of the capture plant, covered initially with a cover plate. It might be wise to include that at the beginning.

“A carbon capture retrofit would generate some hot steam back into the condenser and this has to be fed into the water-steam cycle of the CCGT. Our analysis has shown that it would be highly cost-effective to install a baffle plate on the condenser from day one rather than be installed during the retrofit.

“The baffle plate would comprise less than 1 per cent of the cost of a combined cycle power plant and would not affect the performance of the power plant.” Upon completion of a new Alstom CCR gas-fired plant the plant owner receives a report to be sent to the authorities verifying that all components have been checked and that the plant is CCR.

Retrofitting gas-fired plants with CCS

A CCS retrofit requires the installation significant equipment such as CO2 absorption vessels, CO2 stripper column and a CO2 compressor. “We do not yet know how long it will take to construct the capture units and the associated building, as we have not yet built a full-scale capture unit, but I would expect it to take anywhere between 12 to 24 months from start to finish,” says Philippe Paelinck, Alstom’s director of CO2 business development.

“We would also have to tie in a connection to bring steam to the stripper column, and that’s where we might have to shut down the plant. I believe that this can be done during a scheduled maintenance period, probably a two-to-three week regular maintenance timeframe. We have not yet tested that but we think it’s realistic.

“As well as the space for the capture plant, there is also space reserved in the switchyard for additional transformers. There will be some downtime when you make those connections.”

While there are no changes necessary to the heat recovery steam generator (HRSG) itself, a CCS unit will cause an increase in the back pressure of the water-steam cycle. Alstom will return the steam from the plant and extract the steam from the steam turbine crossover pipe, which connects the CCS plant to the combined-cycle plant. This would need around 35 days of plant downtime to install, but the company says it could be done as part of a regular hot gas parts inspection process as not to further increase downtime.

Mitigating CCS efficiency penalties

It is well known that there is a heavy energy penalty imposed from the carbon capture process. Most of the penalty arises from supplying steam supplied to the CO2 stripper column and from the extra electricity needed to power the CO2 compressor, which pressurizes it to 100 bar.

“On a gas plant we expect a 10 to 15 per cent efficiency penalty in absolute terms, translating to an overall efficiency loss of 6-8 points for a 60 per cent efficient CCGT,” says Paelinck. To reduce the efficiency penalty Alstom is contemplating recycling parts of the flue gas to the inlet of the turbine to enrich the CO2 in the flue gas.

“We think it could have an impact on the capex to reduce the size of the required equipment, but maybe not so much the efficiency. The efficiency depends on the quantity of CO2 per megawatt needed to be removed and so there is little we can do to reduce that. The only option is to use better quality solvents, which could improve efficiency by a percentage point or two. It will be very difficult to reduce the efficiency penalty further with first-generation carbon capture technologies.”

Foster Wheeler trying to find efficiency mitigation solutions

Foster Wheeler has conducted a number of early project phase exercises looking at the impact of carbon capture on CCGT plant efficiency. A typical amine solvent carbon capture plant with CO2 dehydration and compression units may have more of an impact on efficiency than Alstom’s research suggests, according to Tim Bullen, Foster Wheeler’s CCS manager.

“We see a nine percentage point drop to around 51 per cent efficiency for a 60 per cent efficient CCGT operating at full load, depending on the CO2 capture rate and the discharge pressure for compression,” he says.

Foster Wheeler’s findings are based on performance simulations using in-house and public domain gas turbine performance and a generic MEA-based amine system, not on a particular proprietary licensed technology. “Whether you take Alstom’s solvent, Aker’s solvent or Mitsubishi’s KS1 solvent, they all have some slight differences in performance, but from what we’ve seen there is not a dramatic change.”

Bullen says the main contributor to the net reduction in power output results from the loss of steam turbine output, which is due to the steam extraction for the reboiler within the capture unit and the power required for CO2 compression, either from direct electric power or from steam. There are also further demands from smaller units like the gas blower, additional cooling loads and pumping the solvent.

Improved solvent formulation will help mitigate efficiency, says Bullen, but there are certain engineering solutions like improvements to CO2 compression techniques that will also reduce efficiency losses. However, these are likely to be relatively small on the overall impact on efficiency.

“We’ve looked at heat recovery to improve efficiency,” explains Bullen. “We’ve looked at waste heat that’s currently thrown away to cooling water to the CO2 compressor and using that heat within the CCGT to heat boiler feed water. These all help but they won’t achieve massive changes in efficiency in themselves.

Another problem to overcome is the additional pressure drop on the flue gas. “The general consensus is that you need a flue gas blower downstream at the HRSG, otherwise you end up back pressuring the gas turbine, which would impact its performance,” Bullen says. How the CCGT and the capture plant are laid out and their locations relative to each other will have an impact on the power required for the flue gas blower, he adds.

The challenges of CCS under part-load CCGT operation

A more pressing problem concerns the steam turbine and the need to extract low-pressure stream to regenerate the amine in the reboiler under part-load operations. Foster Wheeler is currently conducting research for an unnamed client into CCS operation at part-load for CCGTs.

“There are some challenges and considerations that need to be looked regarding the steam between the outlet of the medium-pressure turbine and the inlet of the low-pressure turbine sections,” Bullen says. “Under part-load, the pressure within the steam turbine will tend to fall while you still want to maintain pressure conditions to the amine system. This is a challenge.”

The challenges of part-load, CCGT flexibility and meeting grid code requirements are not a CCS-killer, but they do present a significant problem. “There are things you could do with the CCS system so that the grid code can be met. For example, you could shut down the CO2 compressor and export to the grid the auxiliary load saved, but there is an impact on doing that because then you’re not exporting CO2 to the pipeline.

“What’s the priority? Is it exporting CO2 or is it maintaining power supply to the grid? There needs to be some understanding of the overriding requirements of the plant and then design a system to work within those stipulations. We’ve done a lot of desktop studies and some early FEED work but no-one has taken the next step of putting kit on the ground.”

How much does CCS cost?

Unofficial reports suggested Scottish Power’s Longannet project fell through at the eleventh hour because it was asking for an additional £500m to complete the project, and the UK Treasury was not willing to spend more than the original £1 billion allocated. Alstom says CCS, whether on coal or gas plants, is competitive with alternative low-carbon technologies.

Paelinck says its reference plant puts the levelized cost of electricity for a state-of-the-art 600 MW CCGT power plant commissioned in 2015, integrated with CCS and operating in baseload, at €65/MWh ($86). Without CCS, the levelized cost of electricity for the reference plant is €43 per MWh, meaning the cost of CCS adds another 50 per cent.

Alstom cannot put a price on retrofitting CCGTs with CCS. “It would be highly dependent on location at whether the plant is capture ready or not,” says Paelinck. “Given our experience of retrofitting the water-steam cycle to open-cycle gas turbines, I would expect capex costs to be 15-20 per cent higher compared to a plant designed for CCS from scratch.”

Adding 15-20 per cent on the capex will translate to 10 per cent additional overall cost, says Ladwig, or approximately €70/MWh for a retrofitted CCGT with CCS.

Making CCS pay

Alstom calculates that the cost of saving a tonne of CO2 emitted from CCS at €75 per tonne in 2015. The current carbon price is barely €9 per tonne and Paelinck admits that the chance of the carbon price rising to this level is extremely slim.

“Unless we have dramatic changes in European policy regarding the EU ETS, a utility’s decision to build a CCS plant won’t be based on the carbon price alone for the foreseeable future,” he says. “If you want CCS to start in 2015 on the back of a carbon price you need it to be €80-€90 per tonne to trigger investment, but on cost grounds it needs to be above €75 per tonne.”

Paelinck says the carbon saving costs of wind and solar are more like €150-€200, but thanks to feed-in tariffs these technologies are being deployed. “The UK’s Electricity Market Reforms, which will convert the Renewables Obligation subsidy scheme to a feed-in tariff with contracts for difference is a good option that will kick-off CCS on a competitive basis. Our customers will then look at CCS versus wind, solar or hydro.”

Even with dedicated government subsidies, the investment scenario for CCS is tough. The increasing penetration of renewables has dented the operational hours of fossil fuel power plants and utilities wishing to invest in new plant have a headache.

“Decision-makers will, slowly but surely, realise what’s going on and realise we need a price for decarbonized electricity that includes the costs of dispatch,” says Paelinck. “What we are proposing with CCS is to augment the capex of power plant in order to decarbonize, therefore exposing those plants to even more sensitivity to the number of operating hours.

“We’re probably going to see capacity payments made for fossil fuel backup plants. I can’t see any other way for our customers to invest in new plant.”

The problems of storing CO2

Once governments and industry have cracked how to monetize carbon capture, the other crucial element of CCS – storage – needs to be fixed. There is general impression that captured carbon dioxide can be easily transported across the existing natural gas pipeline infrastructure, swapping CH4 for CO2. That could be highly dangerous due to corrosive ‘dense phase’, pressurized CO2.

The problem is that CO2 captured from power plants always contains moisture. Wet CO2 is very acidic and the potential for corrosion, leakage and even explosions is such that dedicated CO2 pipelines made from expensive corrosion-resistant steel may have to be used.

Dr. Ward Goldthorpe, who heads up the UK Crown Estate’s CCS programme, says a huge amount of technical work needs to be done for regulating CO2 with impurities, i.e. water. “The regulatory framework is essentially adapted from the US petroleum industry, but a lot of CO2 transport in the US is pure CO2. Devising standards for the CCS industry that can cope with CO2 plus impurities is still a work in progress.”

Goldthorpe says the major stumbling block for CO2 storage from power plants is the lack of a viable business model. “Unlike the enhanced oil recovery (EOR) projects in the US, we are trying to implement in one fell swoop integrated CCS projects with no associated value proposition at all. The public funding is not prepared to underwrite the awkward risk-sharing and liability issues which pop out of the integrated model.”

Paelinck agrees. “We don’t have a business model for CCS in Europe because the carbon price is too low and the opportunities for EOR are quite scarce. We have some in the North Sea but it won’t be enough to supply the big market everybody dreams of. In the US the price for EOR is $20-$40 per tonne of CO2 but that’s not enough to justify CCS with gas.”

DECC says developing CCS is an “uncertain, potentially time-consuming, costly and risky business opportunity”. That is putting it mildly. If CCS is to become a viable commercial proposition then the various technical, regulatory and financial hurdles must be overcome. Just don’t expect CCS to be ready any time soon.

Discussion

No comments yet.