Driven by European Union renewables targets, demand for biomass wood pellets is set to soar over the next decade as utilities displace coal in thermal power plants. Tim Probert explores how the industry will manage to procure sufficient sustainable biomass. This article was first published in the July 2012 issue of The Energy Industry Times.

Global trade in biomass pellets could hit 60 million tonnes by

2020. Source Deutsches Pelletinstitut

While utilities can and do burn hundreds of different types of biomass, literally almost any old rubbish such as chicken litter, peanut husks and olive stones, the most cost-effective biomass to displace coal in co-firing and conversion plants in large volumes are usually wood pellets.

At present, the global trade of wood pellets is a manageable 10-12 million tonnes per year. However, the use of pellets is rising rapidly, driven by European Union (EU) targets. Around half of the EU’s target for providing 20 per cent of energy from renewable sources by 2020 will be made up by biomass, according to member states’ national action plans.

According to the European Pellet Council, pellet imports to the EU increased 50 per cent in a single year 2009-2010 to 2.5 million tonnes, while trade within the EU rose 60 per cent to 3.45 million tonnes. Overall, global trade could hit 60 million tonnes by 2020, it says. Meeting this demand will require large investment in both feedstock for wood pellets and processing, while at the same time it needs to endure supplies are sustainable.

Sourcing wood pellets

Utilities are used to purchasing commodities towards the end of the supply chain, i.e. at the port of loading or discharge, on a long-term basis. At present this is simply not possible on a viable scale with wood pellets. Some utilities have recognised the upstream risks by building and operating their own pelletization plants to increase security of supply.

However, this still leaves them fully exposed to fibre risks and therefore the price and volume of biomass is difficult to secure in the long term, as Diekumo Anthony, biomass fuel developer at E.On Climate & Renewables, explains.“The primary feedstock of pelletization plants is sawmill residue and forestry residues like bark,” he says. “They are by-products of another market altogether. The entire biomass fuel supply chain on the power side is reliant on subsidies, while upstream the feedstock is led by the demand for timber from the US construction industry.

“So the entire supply chain is floating in the middle of two uncertainties. Therefore, the price and volume of the feedstock for wood pellets is completely dependent on other markets. That presents huge risks in developing a secure biomass supply chain.”

The bulk of feedstock for wood pellets in North America, which accounts for two-thirds of EU imports, comes from small landowners, with the rest coming from a handful of large forestry product companies traditionally supplying pulp, paper or other wood-based products. Anthony suggests the only way to manage fibre risks is to take control of the supply chain as far upstream as possible, and partnering with forestry product suppliers owning vast tracts of forest.

Big role for forestry product companies

One such company is Weyerhaeuser. The Washington state-based company is the world’s largest private sector owner of softwood timberland, managing more than 20 million acres of forest in the US and Canada, and one of the largest pulp and paper companies in the world. James Leitheiser, Director of Global Business Services for Weyerhaeuser Solutions, believes the power industry is needlessly reinventing the wheel by manufacturing a product it does not truly understand.

“The paper supply chain does not exist in a vacuum; it is integrated with traditional forestry products. The economics of the supply chain mean that biomass has to be integrated into these products as well. The paper industry has learned these lessons 50 years ago.”

In other words, says Leitheiser, utilities should leave wood pellet manufacture to forestry product companies who can harness their natural economies of scale in terms of feedstock and expertise to offer long-term security of supply. Weyerhaeuser is pushing what it calls its ‘Resource Forward’ model, which it says would reduce project risk and commercial risk for investors.

In this model, a large timberland owner with strategically located resources would bring the supply chain forward via an institutional investor to provide stable, relatively low-cost capital to build a pelletization plant in conjunction with an offtake partner. The offtake partner could be a utility, or it may be a biomass supply intermediary, such as a commodity trader or an agribusiness, delivering wood pellets to European ports.

Leitheiser says the also model incorporates an element of floating prices so that trading companies can partake in price risk. “It’s almost always cost-effective to source some supplies on a short-term, spot basis from third parties, but having a long-term anchor supplier offers a great deal of security to end- use customers and investors,” he says.

This ‘Biomass, Inc.’ model is proving very attractive to investors. Dr. Chris Rowland, senior research analyst at Ecofin, an investment management company specialising in energy, says biomass on the cusp of a huge change. “Many companies are eying investment in the biomass feedstock supply chain. We see potential in investing in assets along the entire chain, owning forestry, pelletization plants, as well as storage facilities at UK ports.”

Trading biomass

As utilities tend to produce pellets themselves, pricing biomass can be a challenge. In November 2011, Amsterdam-based energy exchange APX-ENDEX launched the world’s first biomass exchange. In phase one, the exchange started with non-cleared wood pellets, meaning the physical settlement is arranged bilaterally between the counterparties after trade has been concluded.

Phase two, scheduled to take place later this year, will include the implementation of clearing services for wood pellet contracts with contribution of Port of Rotterdam’s ‘BioPort’ with regards to shipping, storage and distribution. By utilizing these contracts, says APX-ENDEX’s futures manager Paul Groes, end-users and institutional investors can hedge themselves against price movements, while producers will be able to sell biomass on a longer-term basis in order to access working capital.

Dry bulk terminals at BioPort Rotterdam are used for handling, storage and export of a growing biomass flow, already serving big players

like E.On and Essent.

An important challenge which the industry has to overcome is the lack of international standardization of wood pellets. Peter Rechberger, general manager of the European Pellet Council, says wood pellets need to become a clearly defined commodity in order to compete against fossil fuels. “There is no EN (European Standard) for industrial pellets yet, although the power sector has virtually defined its own industrial pellet qualities: I1, I2, I3,” he says.

“We are working with IWPB (Initiative for Wood Pellet Buyers) to include industrial grade certification as part of PellCert, which aims to develop an ENplus-compatible certification scheme for industrial wood pellets that also incorporates sustainability.”

Sustainability, sustainability, sustainability

Sustainability is absolutely critical is to the biomass industry and utilities are acutely aware of this. Hitherto, many European utilities have effectively self-certified their biomass as sustainable. The ‘Sustainability Policy’ of British generator Drax, for example, dictates that it will not burn any biomass that does not reduce carbon dioxide versus the coal alternative.

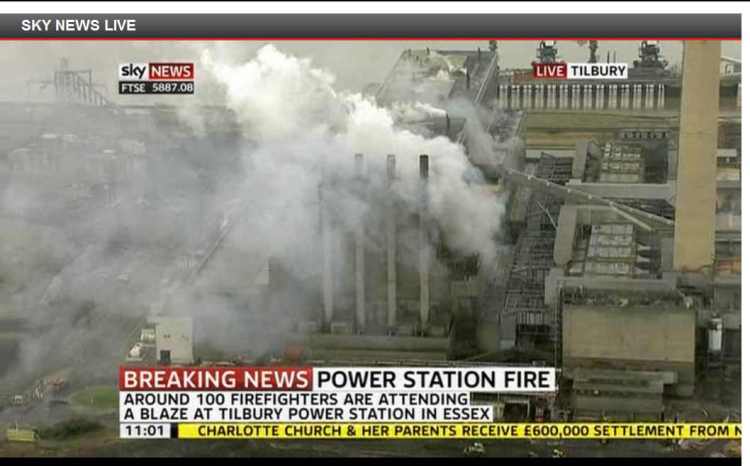

As demand grows, however, an increasing volume of fresh wood will be needed from forests, the use of which for sourcing biomass is coming under stricter control from the EU. RWE npower, which operates the ill-fated Tilbury coal-to-biomass conversion plant which caught fire on February 27, says demand in the UK alone could reach 11-12 million tonnes of pellets by 2015, equivalent to 22-23 million tonnes of fresh wood.

Sawmill residues can only be expected to provide 50 per cent of the fibre for this volume of wood pellet production, according to Karine Culerier, Senior Market Analyst, RWE Supply & Trading. “More and more volume from sustainability-certified forests will be needed,” she says.

The increasing volume of fresh wood required has boosted sustainability schemes such as the RWE npower-supported Green Gold Label, which requires forest sustainability certification. But there are dozens of such schemes – 67, in fact, according to a University of Utrecht study – and it is slowing down the development of the supply chain.

Jorrit Hachmer, vice president of biofuel trading at RWE, is pressing for a single, European-wide sustainability scheme. “The lack of one is harming the industry,” he says. “We need to convince the public that biomass is sustainable. Without public support, there will be no industry.”

Not all European utilities support the use of biomass in large combustion plants. Dr. Bernhard Graeber, Director of Renewable Energies & International Climate Projects at another German utility, EnBW, would prefer biomass to be burned at its country of origin. “It’s wrong for Europe to subsidize power generation which makes it feasible to transport wood from the USA and Canada. It would actually make more environmental sense for these countries to use this biomass to displace their own coal generation and export more coal to Europe.”

It has yet to be proven whether utilities will be able to source enough biomass on a sustainable basis. Europe is essentially conducting a very large experiment to see if it can.

Discussion

No comments yet.